Health

Khatter Financial – Insurance for Retirement

https://khatterfinancial.com/buildprofile/ = Please finish this assessment and we can make a suitable recommendation and build you an insurance/ annuity profile. In less than 15 minutes of your time we can get you a better rate, plan and more coverage.

https://www.mib.com/request_your_record.html = Been declined on an application, approved other than applied for, received an adverse underwriting decision or a modified offer? We can help clear your past medical issues with the Medical Information Bureau to get you a better rate and more coverage.

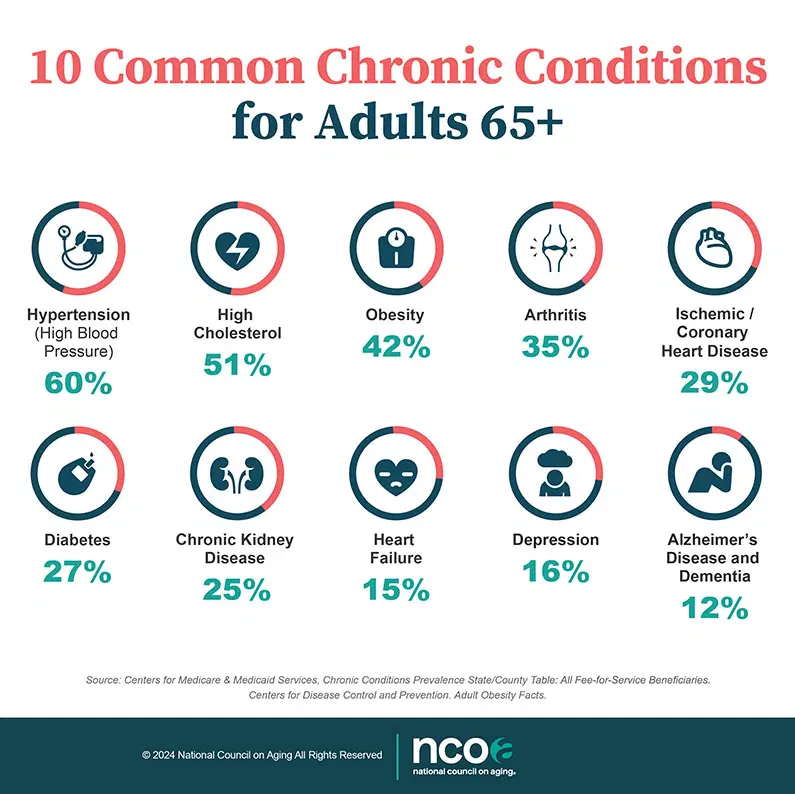

https://www.cdc.gov/chronic-disease/data-research/facts-stats/index.html = Chronic diseases account for most illness, disability, and death in the United States and are the leading drivers of health care costs.

Disability Impacts All of Us Infographic | CDC = Health/ Disability/ Medicare/ Special Needs Planning Information and Request a Quote Below. 👇