Open an IRA

Unlike with employer-sponsored retirement plans such as 401k’s, 401a’s, 403b’s and 457’s where the money is in the employers name your merely a participant not an owner meaning your employer can change plans without your approval, they determine the investment selections or limit your plan’s investment options without your say-so, there is usually a vesting schedule on the employer money if they even offer a matching plan and they can automatically enroll you into the plan and even force an involuntary payout without your discretion, fees and costs are higher 👆 and leaving your job means losing your ability to further contribute to the retirement plan. An Individual Retirement Account (IRA) allows you to put the money in your name it’s your own account 🫵 you do not have to play by their rules and you select your own investments from a much larger pool of options. Your access is unchanged and you can still contribute even if you decide to switch jobs and you can even rollover that old 401k, 401a, 403b or 457 retirement plan and consolidate it into an IRA where the fees and costs are lower 👇 or into a fixed indexed annuity. At Khatter Financial 🦚 we specialize in working with clients and businesses who have been contributing to their employer-sponsored retirement plans while helping them reduce their current years taxable income and getting them a rate of return on money they would have had to otherwise pay in tax. We would love to have a conversation with you about how we can add value to your portfolio.

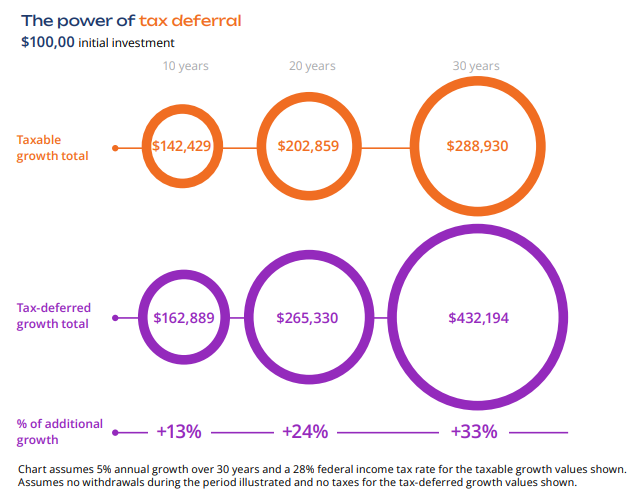

Individual Retirement Arrangements (IRAs) | Internal Revenue Service (irs.gov) = The IRA contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Depending on your situation, you may be eligible to make contributions to an IRA and receive either tax-deferred or tax-free distributions. You have until April 15, 2025 to make a contribution for tax year 2024. Please submit ahead of time to allow a few days for processing do not wait until the last minute. Contact us and we can objectively consider which options may be best for your retirement goals.

Compound Interest Calculator | Investor.gov = Compound Interest Calculator. Contact us for assistance.

https://www.investor.gov/financial-tools-calculators/calculators/required-minimum-distribution-calculator = Calculate your required minimum distribution (RMD). Contact us for assistance.

Inherited IRA RMD Calculator | Voya.com = Inherited IRA RMD calculator. Contact us for assistance.

Retirement topics – Beneficiary | Internal Revenue Service (irs.gov) = SECURE Act Changes

Roth acct in your retirement plan | Internal Revenue Service (irs.gov) = Both contributions and earnings are tax-free either after 5 years or over 59 1/2. Contact us for assistance.

sep-retirement-plans-for-small-businesses.pdf (dol.gov) = A self-employed business owner can contribute up to $69,000 or 25% of your compensation for 2024. Contact us about how a SEP IRA can be a good option for your business.